At the end of February, Shhh, Dashen shows off his CJ account in the CJ group: although it's not much, it's only $51, which has just reached the minimum payment requirement of CJ, but the significance of the $51 is extraordinary, because it's easy to do other alliances after CJ is finished. The company's vision is to move money from one place to another at the fastest speed and at the least cost. Open the official website, of course, the most attractive is the MasterCard debit card, but it does not support Chinese applications. However, the platform provides virtual bank accounts in five currencies, which can be used for collection just like ordinary local bank accounts, giving me some comfort in my loss. The five currencies are:

pound

euro

dollar

Australian dollar

New Zealand Dollar

As shown in the figure:

The functions of these five bank accounts are as follows:

Collect remittance from advertising alliance, such as CJ, zanox, etc. If your Google Adsense account is a U.S. account, you can also use this U.S. bank account to collect money. General bank accounts can do things, these bank accounts can do.

For PayPal withdrawal, now China's PayPal withdrawal to the Bank of the United States to charge a 35 dollar handling fee.

Collect payment from rebate websites, such as topcashback, befrugal, etc.

You can hold and manage more than 40 currencies, which allows you to avoid exchange rate changes and prepare for future transfers. As shown in the figure:

It can be remitted to more than 50 countries and regions, as shown in the figure:

As you can see from the above, you can remit money to China, so it is very convenient to withdraw cash after collection. When your transferwise bank account receives the money, you can withdraw it to your domestic bank account or remit it to someone else's bank account. According to shush Dashen, the withdrawal of US dollars will be automatically converted into RMB according to the exchange rate of the day and remitted to your UnionPay card, which will arrive in a few minutes. In view of the excellent platform, it is strongly recommended that you register one immediately, and the registration is free.

Registration process

The official website, transferwise.com, now has a free transfer limit of 500 pounds. After opening, click sign up in the upper right corner, or

Claim your free transfer under the send money menu

Get your account under the receive money menu

Order a card under the debit card menu

Either way, the following registration interface will be opened:

I think most people use it by themselves, so choose personal, then input your email and set a password. The password needs to contain numbers and letters, at least 9 characters. Of course, you can also log in directly with your Google or Facebook account, but it is not recommended. After all, these two things are not convenient to visit in China. Transferwise won't misuse your data, as explained in the figure below.

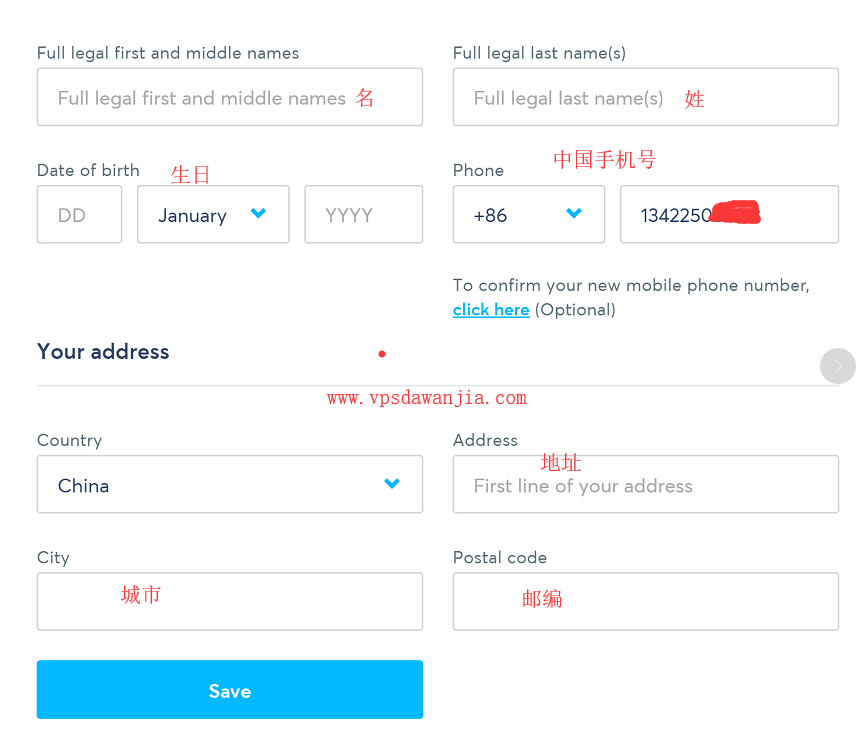

At this time, your email should have received a verification email titled "confirm your email address" sent by transferwise. Click the link in the email to verify your mailbox. This registration process is a little different from my previous registration process, I don't know why. After logging in, click on the icon of that figure, or open it directly https://transferwise.com/user/profile/view Click Create profile to enter your personal information. When I was registered before, I wrote these personal information first. As shown in the figure:

Please fill in your real information truthfully. If you don't want to be closed, please. The phone number was not verified, probably because I have previously verified the mailbox. I saw crayfish in the tutorial to verify the phone number, but did not verify the mailbox. If you are not in the same situation as my registration process, it doesn't matter, please know.

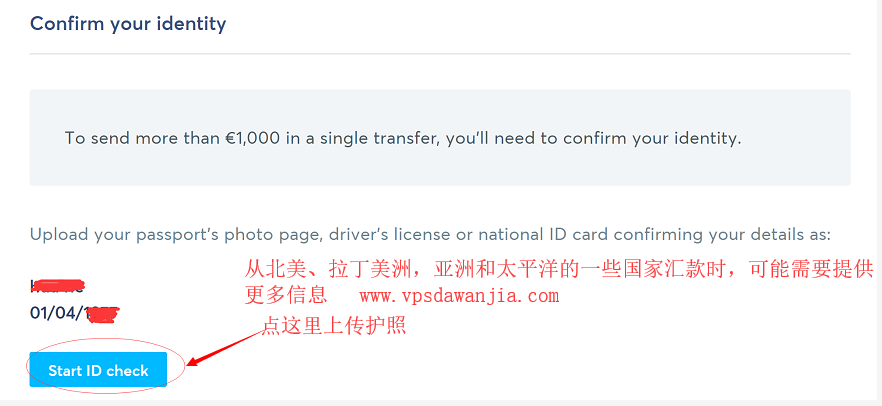

Next, verify your ID, generally use passport to verify, ID card is not good, no English version, foreigners do not recognize (some netizens feedback he used ID card and Bank of China credit card bill certification a year ago, and netizens said that the app can use ID card authentication, you can try it yourself). Click the figure icon in the upper right corner and select verification. Or open it directly https://transferwise.com/user/profile/verification Verification is not necessary, but in order to facilitate collection in the future, I suggest you verify it first. If you need to verify your identity after collecting, but you can't verify it, it's a problem. In addition, authentication can increase the amount of a single transfer (over 1000 euros).

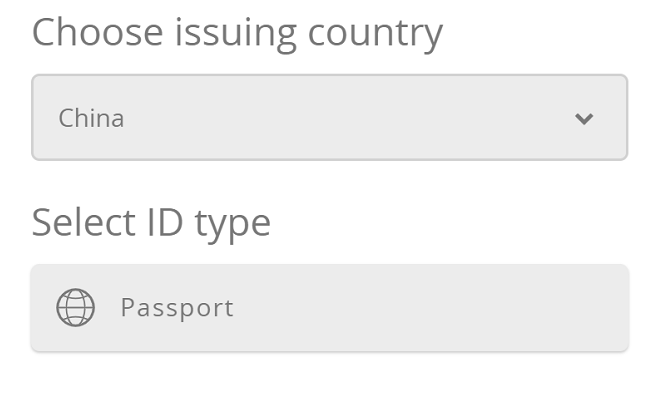

Chinese can only use their passport for authentication, as shown in the figure below

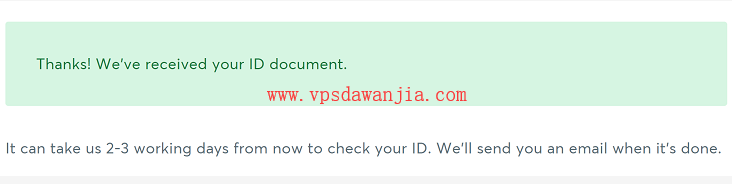

Take a picture of your passport and upload it. You can't use screen shots. After uploading, the quality of your picture will be detected in real time. If the picture is not clear or does not meet the requirements, it will be required to be retransmitted. The prompt after successful upload is shown in the figure:

According to the prompt, the audit will take 2-3 working days, and you will be informed of the audit results by email. In fact, it took me only three minutes to complete the audit when I registered. It took a long time to do this tutorial, but it was still very fast. This time it took eight minutes. At the end of the day, your transferwise will be registered successfully.

Open bank account

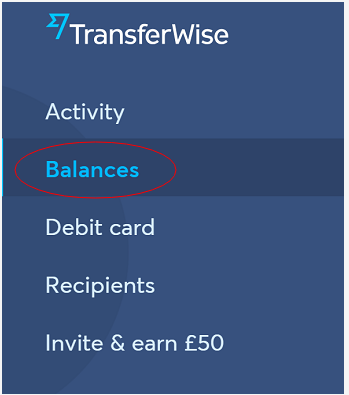

Click the menu balances - get started on the left side of the website, as shown in the figure:

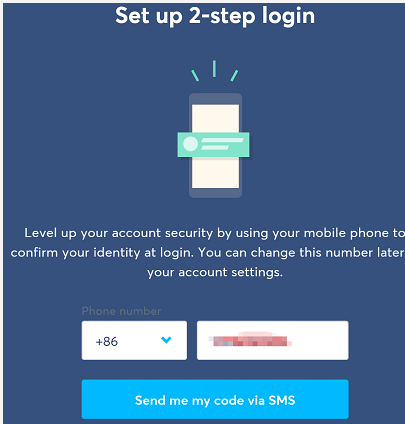

Now it's time to verify the mobile phone. For security, open 2-step login, as shown in the figure:

When registering, I accidentally entered the wrong mobile phone number. No wonder I didn't receive the verification code after waiting for a long time. The mobile phone number can be modified in view personal profile. After verifying the mobile phone number, pop out the following window,

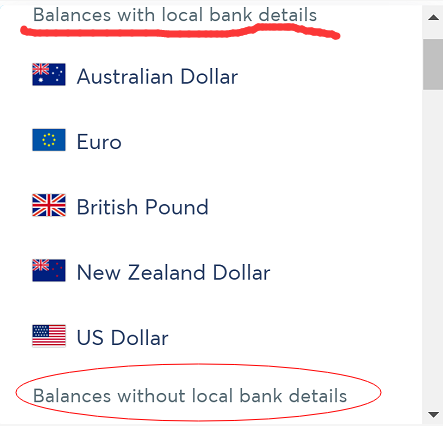

Look at this picture. There are two options

Balances with local bank details

Balances without local bank details

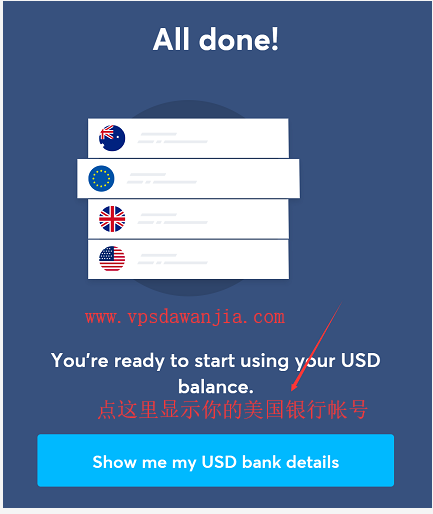

As you can see, there are only five currencies including pound sterling, euro, US dollar, Australian dollar and New Zealand dollar with local bank accounts. They are not more than 40 kinds of currencies passed by them. I'll try a dollar first, as shown in the picture

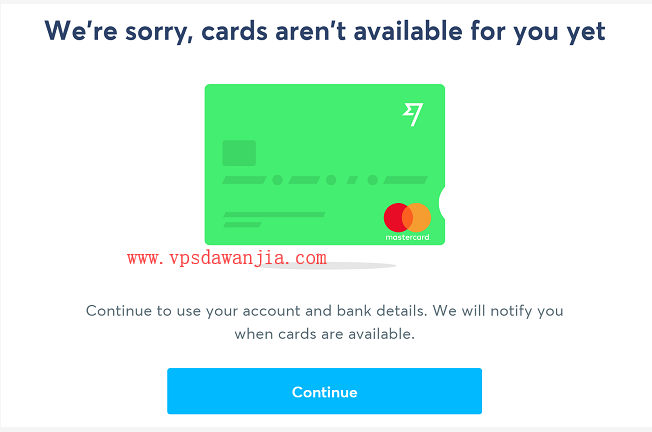

Yes, there are ACh routing number, swift code and account number, which means that the Bank of America account can receive ACh payment and wire transfer. Again, I will not send a MasterCard debit card to me, although I have known for a long time. As shown in the figure:

OK, the application for us dollar account is successful. You can apply for local bank accounts in pound sterling, euro, Australian dollar and New Zealand dollar in the same way.

This is a standard bank of America checking account. It can receive ACh and wire transfer. It's very convenient. As shown in the figure:

Click Add USD, you can connect your U.S. bank account, add your U.S. bank debit card or credit card to recharge, or wire transfer. The speed and handling charge for recharging $1000 are as follows:

Application for withdrawal

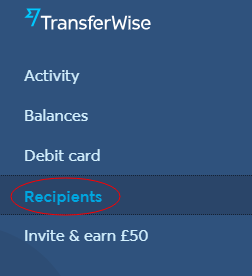

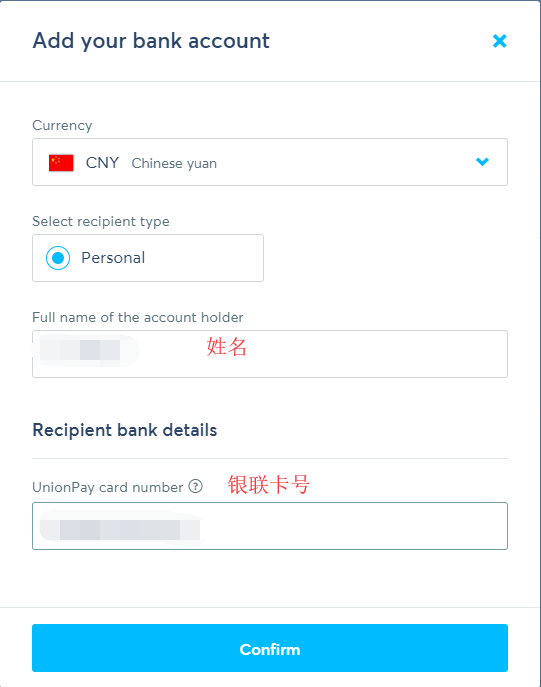

First add your domestic bank account and click recipients on the left

Then click "add your bank account", as shown in the figure:

At the beginning, I entered a card of China Merchants Bank, and the result showed that:

Sorry, TransferWise can’t pay out to that UnionPay card. It could be connected to a business account, or an unsupported Chinese bank.

Try changing the card of a state-owned bank, such as industrial and Commercial Bank of China

The card of ICBC has been successfully added, as shown in the figure:

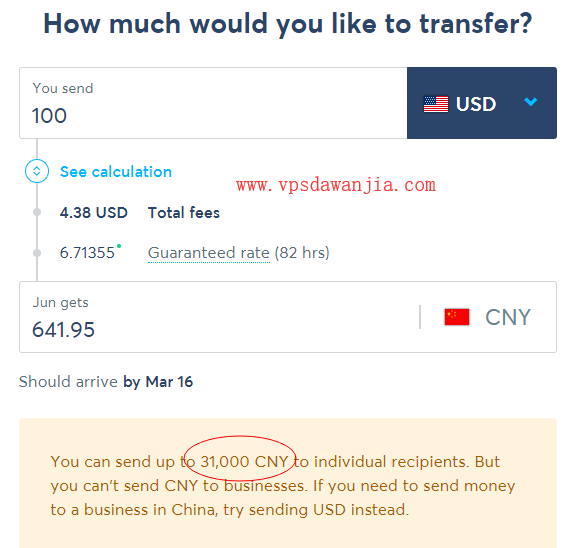

Click "send money" under the account number to apply for withdrawal:

Withdraw $100 to test, and the handling charge is $4.38. When I input $10000, the service charge becomes $130.68, which is too expensive. It's not as good as the wire transfer from the Bank of the United States.

Your money is on its way and should arrive in 8 hours. We'll keep you posted. It doesn't work here. It took me a long time to withdraw. Look at the time. It's almost eight hours.

Since I am bound with my American bank card, when I try to withdraw 4000 US dollars, I need to input SSN. Fortunately, I can choose. I am not an American citizen and have no SSN.

Transfer to others

Transferwise is an international remittance and transfer service platform, which can remit money to more than 50 countries and regions. How to operate?

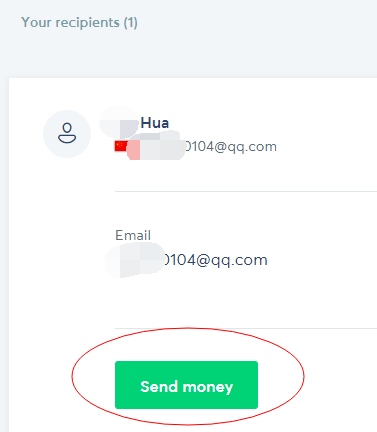

Add payee's bank account number

Recipients - > add a recipient, remit RMB to other people's domestic bank accounts, as shown in the figure:

To remit money, just select the recipient you just added and click "send money". As shown in the figure:

PayPal cash withdrawal

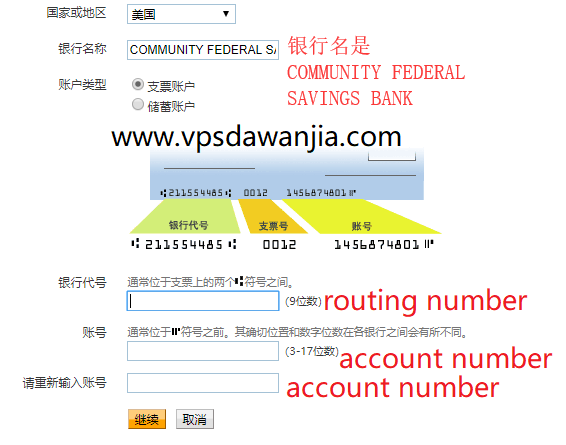

Log in to your PayPal account and click "associated bank account or card" to add the U.S. bank account assigned to you by transferwise, as shown in the figure below:

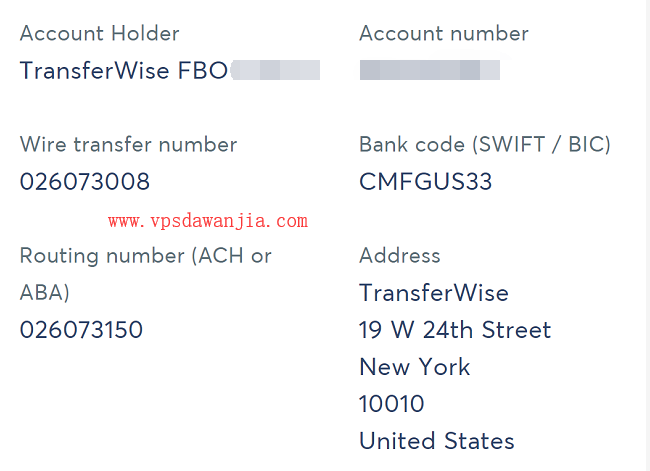

Name of Bank: Community Federal Savings Bank

Account type: checking account

The bank code is routing number (ACh or ABA), and the one assigned to me by transferwise is 026073150

The account number is the account number

Because ACh can be entered into the account under the wrong name, it doesn't matter whether the name is the same or not. For example, the account holder displayed on transferwise is transferwise FBO Jun Wang, but my PayPal name is Jun Wang, which does not affect PayPal withdrawal.

After adding, it looks like this:

On March 17, 2019, I added the U.S. bank account assigned to me by transferwise to PayPal and applied for withdrawal, as shown in the figure below:

从PayPal申请提现到TransferWise

Transferwise will arrive on March 18, 2019, as shown in the figure:

PayPal提现到帐

Recharge your account

If you want to transfer money to others through transferwise, you need to recharge your account first. Credit card is recommended. After testing, we can't use domestic credit cards to recharge transferwise, MasterCard and visa can't, and the specific reason is self-evident. Global payment, Aihui travel branch card, neat, paizhushang, octopus and other Hong Kong cards can be used for recharge. It is recommended to use global payment and Aihui travel branch card because they can use wechat to recharge.

2020.07.05 update: since the beginning of this year, transferwise has changed the verification rules, and it must recharge $20 before getting a bank account in the United States. This threshold is a headache for many people, because the virtual cards on the market can't be used to recharge. At present, the most reliable method is:

ACh transfers $20 from another U.S. bank account. It is recommended to use its own account with the same name, otherwise it may be blocked because of its different name.

Wire transfer purchases foreign exchange from domestic banks and then transfers it by wire, such as ICBC, CCB and other state-owned banks. The reason for remittance can be overseas Amoy. When you remit money, remember to write reference, transferwsie. Use this to identify who remits the money and which transferwise account you want to deposit it in.

Corporate account

Now you can apply for a transferwise corporate account. The application is very simple: after logging in to an individual account, click the name in the upper right corner to open the drop-down menu, as shown in the figure:

Enter company information in the open web page: country, company type, company name, ein and registered address, as shown in the figure:

Then you will be asked if you have SSN or itin. Most people should not have SSN or itin. They can directly choose No. they can choose according to their own actual situation.

After successful registration, click "open a balance" to add a U.S. dollar account. The initial setup fee is $31. I use cable to pay, and Huamei bank's velo should be OK. Generally, it takes 1-2 working days for approval.

Conclusion: for people with Bank of America account number, transferwise has no advantage. It is suitable for small amount of money transfer, large amount of US dollars or wire transfer to save money. However, if you have one more checking account, you can have more CJ accounts to increase your income. It's really a good tool for those who don't have Bank of America accounts and don't want to be limited by P cards.

![[发布于2024/11/17]长期可用免费V2ray订阅+获取地址](https://www.ceacer.cn/zb_users/theme/aymthirteen/style/images/no-image.jpg)

评论留言